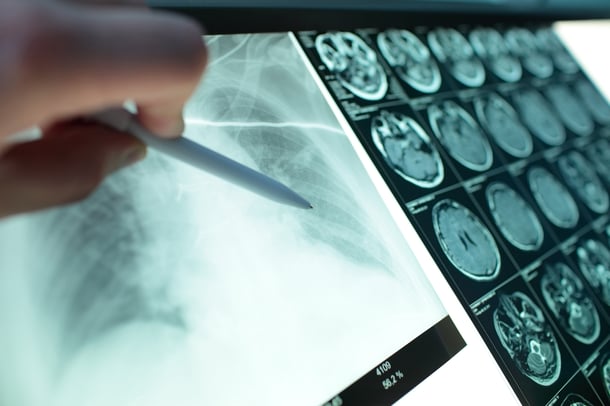

Medical imaging is an important diagnostic tool and one that technology is improving daily. Advanced algorithms can analyze images and flag potentially problematic areas and have even been better than human medical personnel at diagnosis. Medical professionals will continue to rely on this technology as it continues to improve, providing them with ability to focus on the more humanistic aspects of treatment while becoming more accurate with their diagnoses.

As standardization across X-rays, CT scans, PET scans and ultrasound continue to improve, many different organizations can offer advanced diagnostic algorithms for medical image analysis, which are operative across a wide variety of medical imaging platforms offered by various companies. Medical image analysis is an important industry, that features extensive cooperation between corporations, universities, and other research organizations. The overall growth of this industry is strong – but the development of the AI-dependent part of this industry is even more robust.

Medical image analysis and the diagnosis itself is growing rapidly. This market is expected to reach only USD 4.5 billion by 2027, at a CAGR of 8.15% (2020-2027), and it is heavily dependent on innovation. Furthermore, the medical image analysis and diagnosis market component that applies AI and machine learning is expected to have a CAGR of 30.4% (2020-2026). This aspect of medical image analysis is even more dependent on innovation for growth and is therefore extremely important from a tech transfer standpoint. We have identified the top 10 companies that are invested in this technology and are pushing forward with AI innovations. Below, we provide you with a preview of one of our reports.

International Business Machines Corporation (IBM)

One New Orchard Road

Armonk

NY 10504

United States

Commercial Activity

IBM is active in a variety of areas. For this report, we are focusing on IBM Watson Health. IBM is planning to spin out and sell IBM Watson Health to Francisco Partners, a private equity company. IBM Watson Health has a significant AI based diagnostic imaging business.

Clinical Review 3.0, a tool recently launched in the UK, analyzes medical imaging studies and their associated reports to identify potentially missed findings, facilitating higher quality and more comprehensive care for the patient. IBM Watson Health Imaging has recently engaged with Fortrus, Ltd. to grow upon the reseller’s strong relationship with the UK public sector, including a single supplier outcome-based Managed Services framework.

The Imaging AI Marketplace is a single-source solution designed to help simplify the complex process of locating, purchasing, deploying, and managing the vast array of AI imaging applications. The Imaging AI Marketplace is carefully curated and contains only FDA-cleared solutions alongside Watson Health-developed AI solutions.

Patenting Activity

IBM was the number one assignee for AI based medical image analysis when considering patents from 2016 to 2021, with 107 patents/applications in this area. It was also number one for all medical image analysis during the same period, with 728 patents/applications. It co-owns a number of these patents/applications with at least 6 different research organizations.

Partnerships

In 2019, IBM Watson Health announced a ten-year, $50 million investment in artificial intelligence (AI) research partnerships with Brigham and Women’s Hospital (BWH) and Vanderbilt University Medical Center (VUMC).

The two collaborations explore how to use artificial intelligence to improve precision medicine, bolster patient safety, and foster health equity across communities.

Researchers at BWH and VUMC will also focus on how human users interact with artificial intelligence technologies and how these emerging tools can reduce some administrative burdens that contribute to frustration and burnout in the clinical space.

Financial Analysis

We have limited financial information about Francisco Partners, except that they apparently have $25 billion in assets under management. It was cited as the number one money making private equity firm in 2020.

ESG

Both IBM and Francisco Partners have ESG statements, covering each of environment, social and governance topics. IBM also publishes its ESG metrics.

Download our full report here!