At KISSPlatform, we analyze companies and industrial trends to bring you the best commercial intelligence - so that you can make the best data driven tech transfer decisions. We use our proprietary AI platform to analyze tons of data, saving you time and money. But finding new insights with AI isn’t as simple as it sounds.

I’d like to share with you a case in point: categorizing companies by what they offer. Sounds simple, right? And yet even this seemingly simple, clear-cut analysis can actually be quite difficult. Problems can arise due to the complexity of the company itself, as in the case of conglomerate General Electric, which has already announced break up plans.

Other issues can arise because a company may fall into more than one category.

One example you’ll see below is from a publicly traded company called Absci Corporation (stock symbol: ABSI), which describes itself as “an AI-powered synthetic biology company”. For categorizing this organization, which is more important to consider :its proprietary AI platform, or its synthetic biology technology? The answer clearly depends on the question being asked.

Occasionally an AI platform gets a little confused by human language. Some problems are caused by idiomatic phrasing, such as, “beating around the bush,” which involves neither beating nor shrubbery, for example.

Such phrasing is easily understood by humans, but causes confusion in AI. Fortunately, at KISSPlatform, we’ve improved our AI platform to a high degree of accuracy in understanding.

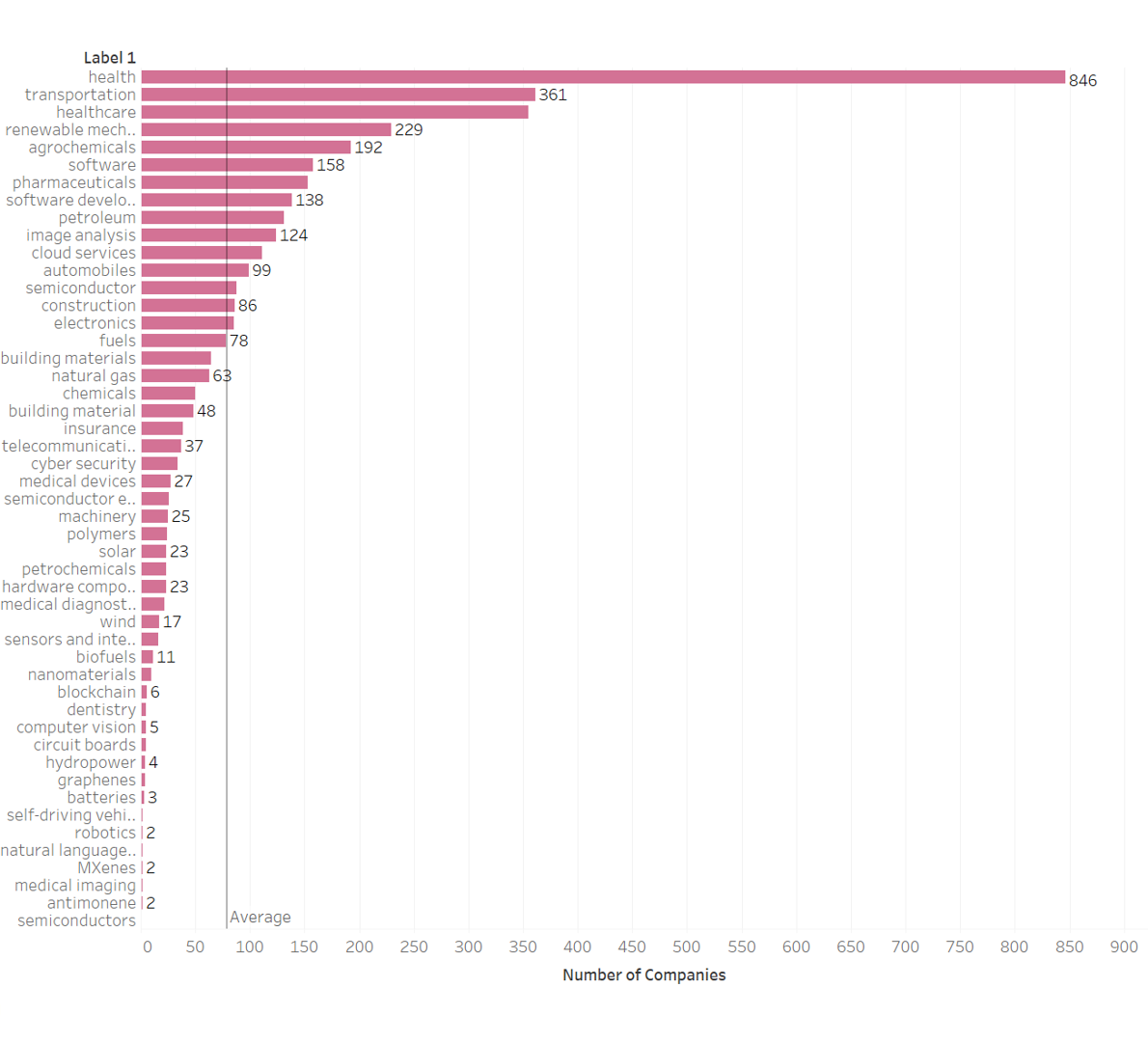

How do we know this? Well, like any good AI team, we ran some tests. We gathered the descriptions for publicly traded companies in the US – 3,877 in total. These descriptions are provided by the companies themselves and were obtained through the Yahoo finance API. We also gathered the sector to which that company was assigned, through the same API. These sectors were:

- Healthcare

- Technology

- Energy

- Basic Materials

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

Additionally, some companies were not assigned to any category, and so were given the category of “Null”.

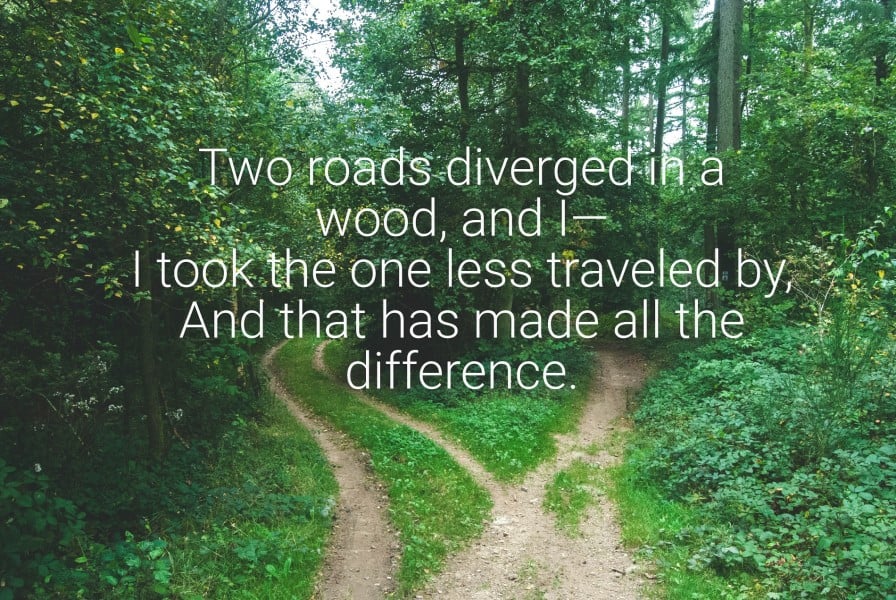

We analyzed the companies’ own descriptions of themselves and their activities in our proprietary AI platform, and then assigned the company to an industry on our list. We have a much longer list of industries as you can see in the below graphs. Finally, we compared our industry assignment to the sector assignment obtained through the Yahoo API.

To start off, Figure 1 shows all of the results of the industry assignment by our AI.

We have many possible industry assignments, generally focusing on areas where we support innovation at research organizations. Not surprisingly, health and healthcare turned out to be very popular choices, because this area is one on which our AI is focused.

The sector assignments from the Yahoo Finance API are given in Figure 2. The “Null” (not assigned) category is not shown.

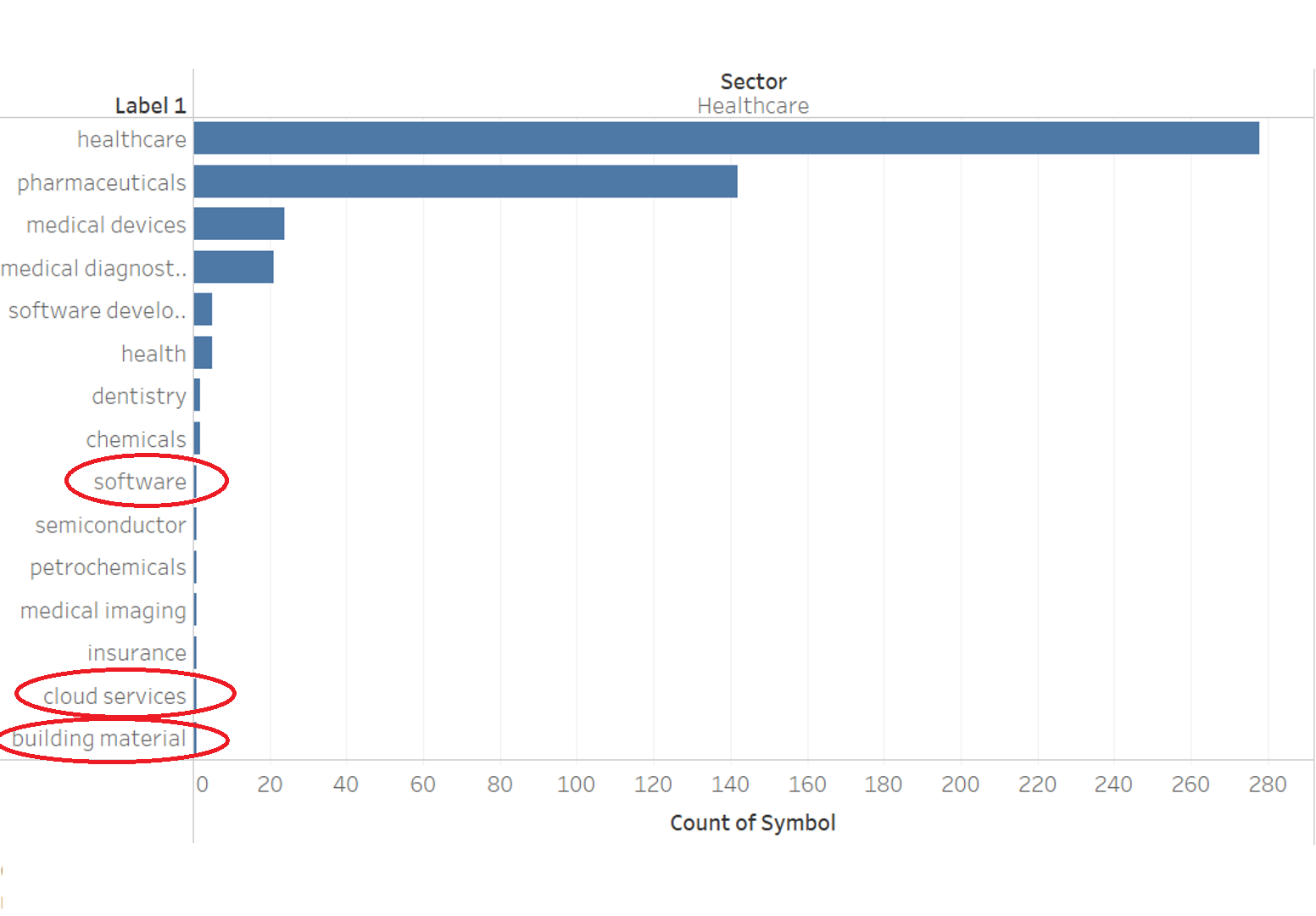

So the real question is, how do our results compare to those from Yahoo? We drilled down to one sector from Yahoo - healthcare - and we analyzed those companies with our AI, to determine our industry labels. As you can see in Figure 3, the results make sense - most companies are assigned one of our labels that belong to healthcare (e.g., pharmaceuticals, medical devices, medical diagnostics and more).

But there are a few interesting outliers, some of which only have one company (three are labeled above). Let’s take a look at these companies, and why our AI chose those industries.

The first outlier is in software - the company that I mentioned before, Absci Corporation. Absci describes itself as “an “AI-powered synthetic biology company”. Absci uses its powerful AI technology to design and develop new drugs in silico; that is, through computer modeling. They help partners to fully develop biotech therapeutics, like new protein drugs, as well to find better drug targets. Our assignment of “software” to this company makes sense, given its emphasis on its own software and how AI powers its business model.

The next outlier is in cloud services. You may ask how a healthcare company could be assigned the industry label “cloud services”, but in this case the assignment also makes sense. The company in question is Doximity, Inc. (stock symbol=DOCS), which provides cloud-based tools and services for medical professionals. Interestingly, according to the Yahoo data, DOCS is assigned to the sector of healthcare rather than technology. For an increasing number of companies that combine multiple sectors and cross-disciplinary fields, limiting them to a single category can be difficult. Our AI focused more on the provision of cloud services by Doximity, and so assigned that industry label.

The last anomaly proves that sometimes human language confuses our AI.  We are always working to improve our AI platform, which is one reason that we engage in exercises like this - manually comparing actual results from our AI to what’s expected, and using the results to improve our AI.

We are always working to improve our AI platform, which is one reason that we engage in exercises like this - manually comparing actual results from our AI to what’s expected, and using the results to improve our AI.

The company in question is Codex DNA, Inc. (stock symbol=DNAY), which manufactures instruments and reagents for pharmaceutical and research laboratories. Our AI platform assigned the label “building material” to the company. With a deeper dive into the results, we found that the next highest scoring label was “health”, with an almost identical score to “building material”. In this case, our AI had two almost equally likely labels. But why did it assign such a high score to “building material”? The key is in the language that the company used to describe itself, which included words like “assembly”. This type of outlier case is one that AI data analysts and engineers are constantly striving to perfect. Strengthening our AI platform’s ability to handle these outliers improves its performance overall.

I hope that you found this review interesting. If you’re interested in learning more about how KISSPlatform can support your tech transfer process, or you just want to talk about AI, I’d love to hear from you.

Please select a meeting time on my calendar - and let’s talk!

.png?width=625&name=Untitled%20design%20(8).png)